Get a Loan in Your Area, Personal or Mortgage | Types of Loans

Welcome to our one-stop resource for all your loan needs in your area. Whether you're in search of a personal loan or a mortgage, we've got you covered. We understand that finding the right loan can be overwhelming, but worry not, as we are here to guide you through the process.

Our webpage is designed to provide you with valuable information on various types of loans available to help you make an informed decision. From personal loans that cater to your immediate financial needs, to mortgages that help you fulfill your dream of owning a home, we have insights and advice to assist you every step of the way.Our goal is to provide you with the knowledge and resources necessary to make the best choice for your specific circumstances.

So, take a deep breath, relax, and explore our webpage to discover the different types of loans available in your area. We're here to empower you with the information you need to make informed decisions and secure the loan that suits your financial goals. Let's embark on this loan journey together!

According to the Oxford dictionary, a loan is anything that is borrowed (especially a sum of money) and is expected to be paid back with interest. Now, Loans are of two types:-

A. CONSUMER LOANS

Consumer Loans are of multiple types. At one glance it would look like this:

1. HOME EQUITY LOANS AND RE-MORTGAGE HOME LOAN

You can take a home loan for your new property, based on the property value, and your income tax papers. Most banks will require and margin money of 20% of the property value, plus your property registration costs, so you will need to have this in liquid form in your bank account. The interest rate varies from bank to bank, so remember to check a few banks and NBFCs, (non banking financial corporations), before you settle down with a bank. There may be a processing charge as well. You can also submit your income papers and get a pre approval, generally valid for 6 months, and then search four property of home.

If you already have a home loan or property loan with a bank or no bank, consider re mortgage loans, which basically means shifting your loan from one bank to another. There may be multiple advantages, like, you may get a lower interest rate, saving your thousands per year, you may also get a top up cash loan, which you may need in your business, daily life, house improvement or to pay off other expensive loans.

Use the search box below to search for home loans or remortgage loans in your area:

These loans are popularly known as Home Equity Lines Of Credit (HELOCs) and they use the consumer’s home/property as a source of collateral. As a result, rates of interest are much lower. However loans and lines of credit have one basic difference. The former has a fixed interest rate and entail monthly payment whereas the latter, has variable interest rates and a flexible payment schedule. Having equity in your house makes it worth more than you owe it.

2. STUDENT LOANS

Students are offered loans by federal commercial banks for their education. While some students prefer private loans, most opt for federal loans.

Federal loans are of two types:

| Subsidized Loans | Unsubsidized Loans |

|---|---|

| Meant for candidate with maximum financial need. | Meant for the average student borrower; irrespective of financial stability. |

These loans have the same rate of interest for all students.

On the contrary, private companies’ interest rates are dependent on each applicant’s financial situation. Private lenders usually give out loans at a variable rate of interest; meaning succeeding rates increase or decrease in tune with the market rate.

3. AUTO LOANS

These loans are typically taken for purchasing vehicles and automobiles. Popularly known as car loans, they range from a period of 24 months to 84 months. As expected, it took the market by storm in the last two decades; but with more car rental facilities coming into play in today’s world, this industry anticipates a major setback. Unlike property values, car values depreciate over time. Owing to this rapid depreciation, short loan terms and large down payments are norm.

4. PERSONAL LOANS

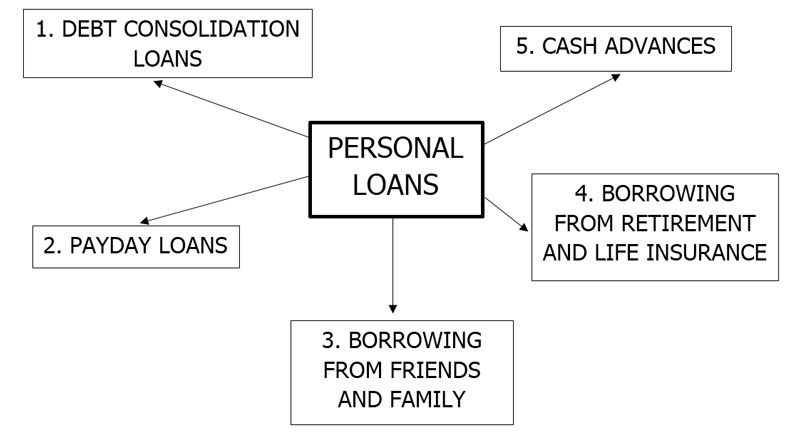

These loans are undoubtedly the most versatile strata of loans. This is because they can be used for an array of purposes, unlike car loans and student loans. Some subdivisions of personal loans are –

(i) DEBT CONSOLIDATION LOANS

These are loans taken to pay off other loans; especially credit card debts. It implies reduced monthly payments and low interest rates.

(ii) PAYDAY LOANS

The role of these loans are to try and bridge the gap between two consecutive paychecks. These loans are usually discouraged by the state due to their sky-high interest rates.

(iii) BORROWING FROM FRIENDS AND FAMILY

As one can figure, these loans are usually informal and not always the best option. Many a times, borrowers and lenders alike think it a good idea to sign basic, simple promissory notes and agreements.

(iv) BORROWING FROM RETIREMENT AND LIFE INSURANCE

This is an instance of one borrowing a loan from his own self. Those with retirement plans and insurance funds can take a loan from these in times of need. Due to the absence of a second party, the stress of repayment is greatly reduced. However, in some cases, failure to repay in a stipulated time period may lead to heavy tax consequences.

(v) CASH ADVANCES

Cash advances are short short term loans taken against your credit card. Instead of using your credit card for regular purchases, you withdraw the money and use it according to your own convenience.

5. SMALL BUSINESS LOANS

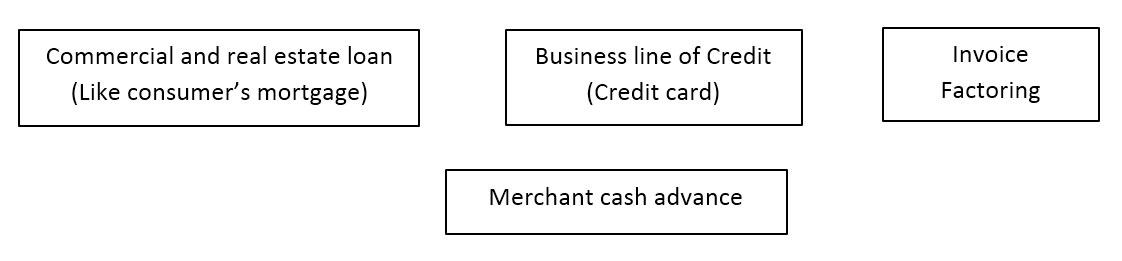

Most Loans taken by businesses are for the same reasons as consumers-buying property, covering short term finances, daily expenses and the like. Some financing products in businesses are-

Business Loans range from a few thousands to many millions and are especially helpful to those who want expansion of inventory, new office spaces or finance other businesses. Money is lent on the basis of minimum credit scores which vary from one bank/lender to another.

Use the search box below to search for business loans and credits, along with working capital loans in your area:

B. MORTGAGES

Any loan taken against property or an asset is a mortgage. The loan is repaid over many years, with interest. Failure to repay results in foreclosure of property. These loans are often taken for education purposes where a house or equally valuable asset is mortgaged to the bank or lender. Many a times home loans also turn out to be mortgages as failure to repay the loan implies that the bank/lender can foreclose and claim ownership of the house. Mortgage rates are usually not very high, although they often vary from lender to lender.

Mother's Day

Mother's Day Good Morning

Good Morning